Starting your journey to financial freedom.

Most people will tell you that the first thing you need to start investing is money. I disagree. It’s interest. No, not the money kind, the normal kind. Success starts with some sort of spark…something that leads to a belief, decisions, actions, and eventually, results.

Folks who seem interested in becoming landlords or house flippers get excited when they hear that I’ve done it. They get more excited when they hear how much I love it or even when I tell some of the horror stories. Their eyes either light up, or they might make a disgusted face. They either think I’m smarter than I am or that I’m a complete moron for dealing with the things I deal with. Either way, it usually gets a visceral reaction.

There are a lot of television shows these days about home improvement and real estate investment. I’ve never paid much attention to those shows, but I’m here to let you know, the reality is probably quite a bit different than what’s portrayed on TV. You’re shocked…I know.

The true nature of the business involves problem-solving, driving efficiencies, and strategizing. As dramatic and thrilling as that all sounds to me, you don’t get much of that on the TV shows.

If you’re wondering if you should become a real estate investor, it will serve you well to answer a few questions first.

Why do you want to do this? If your answer is to get rich fast or not have to work hard, thanks for reading this far, but this probably isn’t for you. Real estate is slow, and it’s hard work.

What do you do for money now? It doesn’t matter, but the answer may help you decide what area of REI to focus on. Maybe you’re a salesman. Maybe you’re great with numbers but bad with people. Are you more hands-on?

Are you a hustler? In my experience, if you are, you’ll probably do well at most things as long as you’re willing to learn.

How do you feel about people, in general? To be successful, you’ll need to work with them…

The answers to these questions don’t determine if you’ll be successful, but they can help in setting a direction toward success.

Folks who think all landlords are all rich and the business is easy always fail. Another subset of people who always fail is the spectators. These people will sit on the sidelines forever, tell you they want to take action but then always dodge when it’s time to get in the game. They boggle my mind, and I feel bad for them. I do understand, though. It’s scary, and they are risk-averse. I’m always cordial, but I don’t have too much time to spend on those folks unless they want to act. It’s great to see them into action, but rare.

Similar to many, the reason I became a real estate investor was to build wealth and gain financial independence. Today, I almost cringe when I see folks struggle as they rely on nine-to-five jobs to provide their financial security. Don’t get me wrong — I still have a nine-to-five — and while I know many people who have significant incomes and great job security, that’s not enough for me. Relying on someone else to pay me as the sole means of my financial security is anything but security. And…it’s not wealth. I learned this the hard way.

I lost a job a few years ago. I felt thrown away, discarded, like trash. What about all those years of service? I soon found out what many people find out when this happens. We bet on our W2 income to grow and provide us with savings and future security. If we can, we save for “someday” with plans to retire, travel, and fish. Then we wait. If we are really lucky and nothing screws up, we retire and get to start chasing our dreams. At sixty-five years old! Sounds like a bad joke, a cruel joke. If you agree, maybe you’ll like Tim Ferriss’ book, The Four Hour Work Week. The book changed me.

Turns out, like other working stiffs, the more I made, the more I spent, and it always seemed like it was very difficult to save money. Some of us weren’t built for this. We have no discipline in this area. Work and more work we’re good at, but with little satisfaction or comfort as a result. Only the fear that we’re going to lose the work!

The idea of saving up enough money to buy a house to live in, much less to start an investment business, is daunting. Yes, yes, sure, some people work hard and retire comfortably. Some even do it early. I’m not knocking anyone here. I’m just saying, most of us grew up middle class and never learned that all people didn’t live paycheck to paycheck. No one taught us about how money worked.

Do yourselves and your kids a favor. As soon as you think they can understand it, give them Robert Kiyosaki’s book Rich Dad Poor Dad. It’s cliché by now and it’s in every REI article you read, but there’s a reason for that. It’s required reading and it can change your life. Particularly important here is that we often think we need to work for money when money should be working for us.

Listen, I’m not absolved of the fear of financial insecurity, but I tell you what, it’s nothing close to what it was before. The entire world looks vastly different to me today than it did when that asshole fired me. (For anyone keeping track…that’s resentment in print right there.)

So, what’s the trick? How does the wannabe real estate investor get started? What are the actual steps involved in taking control of your financial future using real estate? I’m going to try and keep it simple and focus on the highest-level items first. This information won’t be your end-game, but it may give you a place to start. I stumbled through these, many times haphazardly, and while hindsight provides a clearer view, I’m sharing this in the hopes that someone can benefit from my failures and maybe, from my successes.

1. State Your Why

In his book Start With Why, Simon Sinek goes to great lengths to simplify this first step. You need to know why you’re doing this. For me, I could not rely on someone else’s business to pay me anymore (even if I wanted to). I also knew that I did not want to spend all my time making someone else rich! I had to look at the fact that I was working 50-hour weeks, lining someone else’s pockets to get a paycheck. Furthermore, if it was possible to turn the tables and have money do the work, the possibilities were endless.

I wasted too much time relying on a company to take care of me. Today, my money works for me and its money works for it. Each dollar is a parent with children, and so on. Wealth, to me, means individual income streams designed to be passive, or in part passive, that support themselves over time.

Just a heads up, if your goal is to get rich quick, real estate is not that. You should play the lotto or something. Everything I’ve ever done in this business involved very hard work.

To Be Great with Money You Need a Powerful “Why”

The first step to a successful relationship with money

2. Identify a Niche

Easier said than done, I know, but it doesn’t have to be if you take a few things into account. Establishing your focus area could be tremendously helpful if you can capitalize on what you’re already good at. As renowned author Steven Covey asserts in his book The 7 Habits of Highly Effective People, you should “Begin with the end in mind.” Look at your characteristics to see which align, which could align, and which definitely won’t (if any) align with areas of real estate. To figure out what will work for you, start by writing your strengths on a piece of paper.

Are you a salesman? Maybe wholesaling is a good fit for you. Are you hands-on, a do-it-your-selfer? Maybe house flipping will be your thing. Are you a people person and a good manager? Maybe property management is going to be your strong suit. What kind of time do you have to put toward your real estate investing? Maybe you’re only interested in passive real estate investing. Are you going to be a part-time or full-time real estate investor? These are questions that can help shape your strategy and find your niche.

Case Study: One investor I know of used to manage large numbers of blue-collar employees in his former career. Because he liked people and knew how to manage them, it wouldn’t be too far of a stretch to manage tenants too. He loved problem-solving and understood what it meant to drive efficiency into business systems.

He also had some basic skills needed to handle minor maintenance issues, though he didn’t want to be hands-on forever. He knew that buy-and-hold strategies would eventually result in wealth but only if his property was managed well. He spent the time and learned as he managed his properties.

One, then two, then more. Having many of the skills needed to be a good property manager, this guy was a good match. Where he struggled, he went back to the drawing board, learned, and adapted. He always asked people for help and advice.

Eventually, he was able to train and delegate his work to others as he built a team around himself. After a few years, he was rarely involved with tenants or maintenance issues and was able to focus on the fun parts…getting more deals! That guy was me, and I’m still changing, learning, and taking action.

Going through the self-assessment process will help you zero in on what will work for you. Everyone’s different. For me, I ended up trying several strategies before I decided to focus on buy-and-hold investments with house-flipping as a “side job.”

If you are anything like me, you may still have no idea where to begin. In this case, start talking to other real estate investors and know that it’s ok to take the shotgun approach until you find what works. Here’s a quick template that you can use to get you started: My Strengths Tool

3. Hit the Books

The time spent here is oft contested and comes with a word of caution. Do not get stuck learning and spend no time doing!

Always be taking some sort of action and learn along the way. Mistakes foster your best lessons so get out there and screw up!

If you are going to be a real estate investor, you will need to be educated but the time spent here is different for everyone. My experience was that once I believed I could do it, I started learning from others and educating myself. I also started acting. The tendency for analysis paralysis — where you spend all your time analyzing deals and never making any — can be a powerful foe.

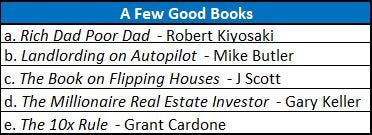

Use resources like the Bigger Pockets Podcast and talk to people who are real-life investors. I used to put the Mets game, mute it and listen to podcasts. If you do this, you’ll start to hear guests who you can relate to telling stories that sound like they could be yours. (You also won’t have to listen to the Mets lose). Read the same books they read, start doing the things they suggest. They have what you want, so do what they do. Within my first year of investing I read dozens of books. Here’s are just five of them:

4. Identify Funding Sources

The good news is, there is a multitude of ways to finance real estate investments. Many times, we have options that we don’t even realize we have. Some people have cash on hand from savings. Other investors tap into things like home equity and retirement accounts. A lot use traditional bank financing and mortgages (until they can’t). Others still, can raise capital using family, friends, and private investors. Partnerships are also a great way to fund real estate deals.

So, what to do if you are low on funds? Where will you get funding? Well, I’ve heard it said that you don’t need to be the one with the money, but you will need to control the money, to start investing. This is only partly true. There are a lot of ways to creatively finance real estate deals. Depending on your strategy (E.g., Wholesaling v. Buy & Hold) it could take less or more.

Let’s look at some places you might be able to get the startup money. If you have equity in your home or a rental, can you leverage that for a Home Equity Loan or HELOC? If you have savings, will you use that in more optimal ways than some anemic savings account? Can you borrow from retirement funds? Do you have family and friends who believe in your vision and would support your investments? Will you opt to look for low or no money down rentals, wholesale, or work as an intern?

Gaining access to some of the best financing options can be time-consuming so it will pay to start getting these feelers out early. If you have credit issues or a lot of debt, don’t let that stop you. There are almost always ways.

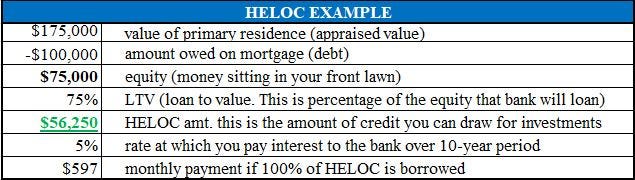

Some people have money in places they sometimes don’t suspect. Maybe it’s IN your front lawn? No, I know you’re not socking away buried cash in the dirt. Not really, no. But if your primary residence has appreciated since you bought it or you’ve paid down principal, you could find equity there. If you think this might be the case, do a quick calculation (see HELOC Example below), then go down to the local credit union or bank and talk to them about a Home Equity Line of Credit, a HELOC. This product could allow you to receive a line of credit based on your home equity.

Here’s how it works in a typical example: Let’s say your house is worth $150k. When you bought it a few years ago, you put down 20% and now you owe $100k. If your house is now worth $175k, banks will lend between 70%-80% of the current value, minus what you owe. For this example, it looks like this:

If a HELOC is not right for you, research owner financing, self-directed IRAs, Solo 401(k), traditional mortgages for FHAs, private mortgages, hard money, or maybe even credit cards. (I bought a house with a credit card once but I would not recommend this for first-time investors.) It’s not for the faint of heart but if you’re interested:

How a Good Deed Turned Into a Property Deed

A House Flipper learns much more than a lesson about risk.

5. Find Deals (and analyze them, lots of them)

If finding deals is not a part of your strategy, you might still be successful — but probably not. And, definitely not as successful as you’ll be if you can find great deals. There are countless ways to go about this and I have tried most of them. I encourage you to try other things, beyond what’s worked for me. My main three strategies are (1) Direct Mail, (2) Digital Advertising (Fb, website, etc…), and (3) Realtors. There are entire books on finding great deals and too many strategies to list but suffice it to say, this may be the most important part of being a real estate investor. So, what’s a good deal look like?

Once you get some leads on the hook, you’d better know how to analyze them. This is where the education and application portion of your strategy comes in. I built my rental property calculator which can be found here: BWD Capital — Rental Calculator. Any questions, send a comment, and I’ll be happy to help!

If you just want to get mildly dangerous, there are a few simple calculations that you can use to see if you’re in the ballpark.

A few examples:

Flips — If it’s a flip, use the 70% rule. The 70% rule states that if the purchase price + holding cost + rehab cost equals 70% of the ARV (After Repair Value) then you are golden. Anything less can still be a good deal but is riskier. For example, the below is a deal that meets the 70% rule:

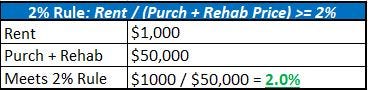

Rentals — If it’s a rental, I use the 2% rule. It’s not perfect, but it can get you pretty close. Depending on the market, I sometimes push this up to 3% because I’m conservative.

6. Build Relationships

Finally and most importantly, whatever you decide to do… be honest and transparent with everyone you’re dealing with.

This might not be the prevailing climate out there but it is the basis for which I built my business. We all have egos and those egos want to show you how great we are. Some of us tend to push when we should relax, to argue when we should listen, and to see things from only one side. Our side.

In my dealings with people, it pays to pause, to try and look at things from the perspective of others. This takes practice. Ideally, you may want to consider what other people want, as a means to finding mutually beneficial solutions, even before considering what you want. People tend to respond better when you put their issues first.

My experience is that everything goes much better when coming from a place of humility and helpfulness; when I try to work with people instead of against them. That doesn’t mean letting people out of commitments or being a pushover. It means remaining accountable to your word and doing the things you say you’ll do. Mind your backyard and keep commitments. Whether you’re in a large city or a small town, the relationships you build can make or break you.

Investors sometimes forget that investing in people and building relationships always results in the highest returns.

Hope this helps.

Leave a Reply